vermont state tax exempt form

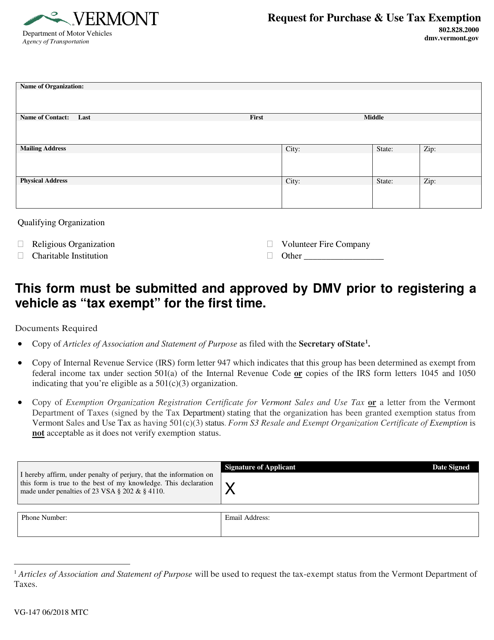

Vermont state tax exempt form Thursday May 5 2022 Edit. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001.

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Exemption Organization Registration Certificate for ont Sales and Use Tax Verma letter from the.

. When you use a Government Purchase Card GPC Click to define. Some cities have local taxes. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language.

State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000. I understand that this exemption apply to DBAs mergers buyouts or does not. Form S-3F Vermont Sales Tax Exemption Certificate For Fuel or Electricity 24383 KB File Format.

Exemption for Advanced Wood Boilers. Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. You will be required to prove that the vehicle was registered in a qualifying jurisdiction for at least 3 years.

Submit a completed Certification of Tax Exemption form VT-014 with a completed. Optional Forms OF This is a list of optional government forms that start with the letters OF. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now.

Assignment of a new VIN if the vehicle does not have one form VT-003. Department of Taxes signed by the Tax Department stating that the organization. 1 PDF editor e-sign platform data collection form builder solution in a single app.

All Forms and Instructions. Present completed VT Resale and Exempt Organization Certificate of Exemption VT Form S3 PDF. Act 194 S276 Secs.

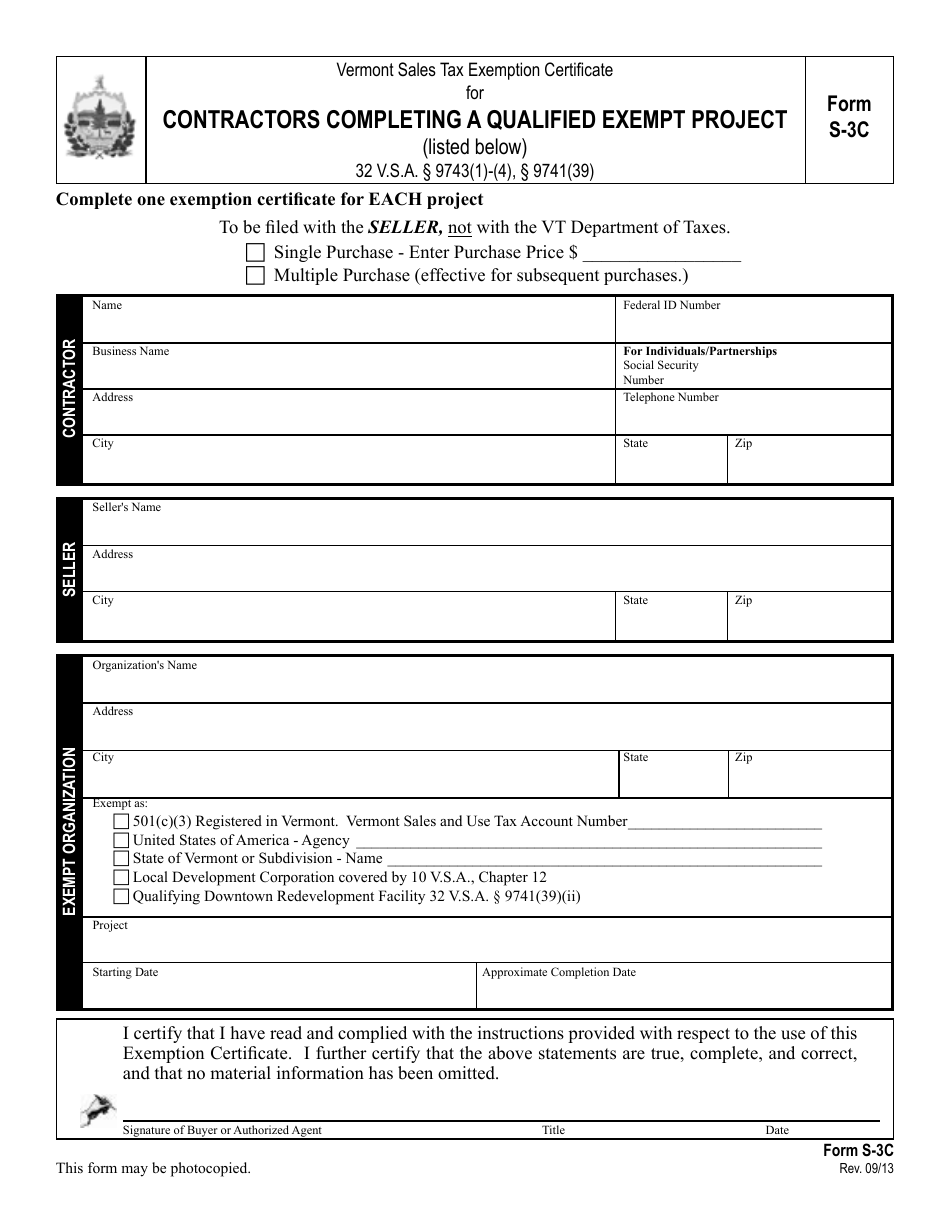

Forms myVTax Help Form S-3C Form Thursday January 23 2020 - 1200 File Form S-3C Vermont Sales Tax Exemption Certificate For Contractors Completing a Qualified Exempt. Your town lister makes the initial determination of whether a property is exempt from tax under the law. Many federally exempt nonprofits are.

120 State Street Montpelier Vermont 05603-0001. Some of these exempt nonprofits must pay Vermont taxes or collect and remit Vermont taxes under certain circumstances which are described below. To request exemption of tax based upon gift when a.

Check payable to the Vermont Department of Financial Regulation. B-2 Notice of Change. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax.

Ad Download Or Email Form S-3 More Fillable Forms Register and Subscribe Now. Tax June 16 2021. 32 VSA 9741.

January 25 2022. 2022 2023 Religious Exemption Form Childcare and K-12 Author. Basic instructions for common Adobe PDF issues.

Other Forms This is a list of forms from GSA and other agencies that are frequently used by. The exemption reduces the appraised value of the home. Exempt Title Affidavit form VT-025 completed signed and notarized.

The certificate is signed dated and complete all. Department of Labor regional offices are currently operating with limited times for in-person services due to COVID-19 and staffing limitationsTo see when. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Fact Sheets and Guides. Sales and Use Tax. Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be.

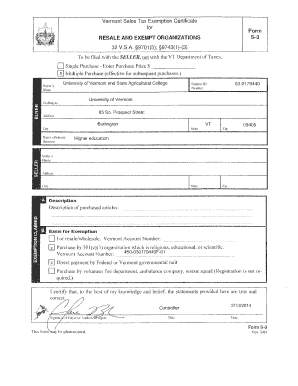

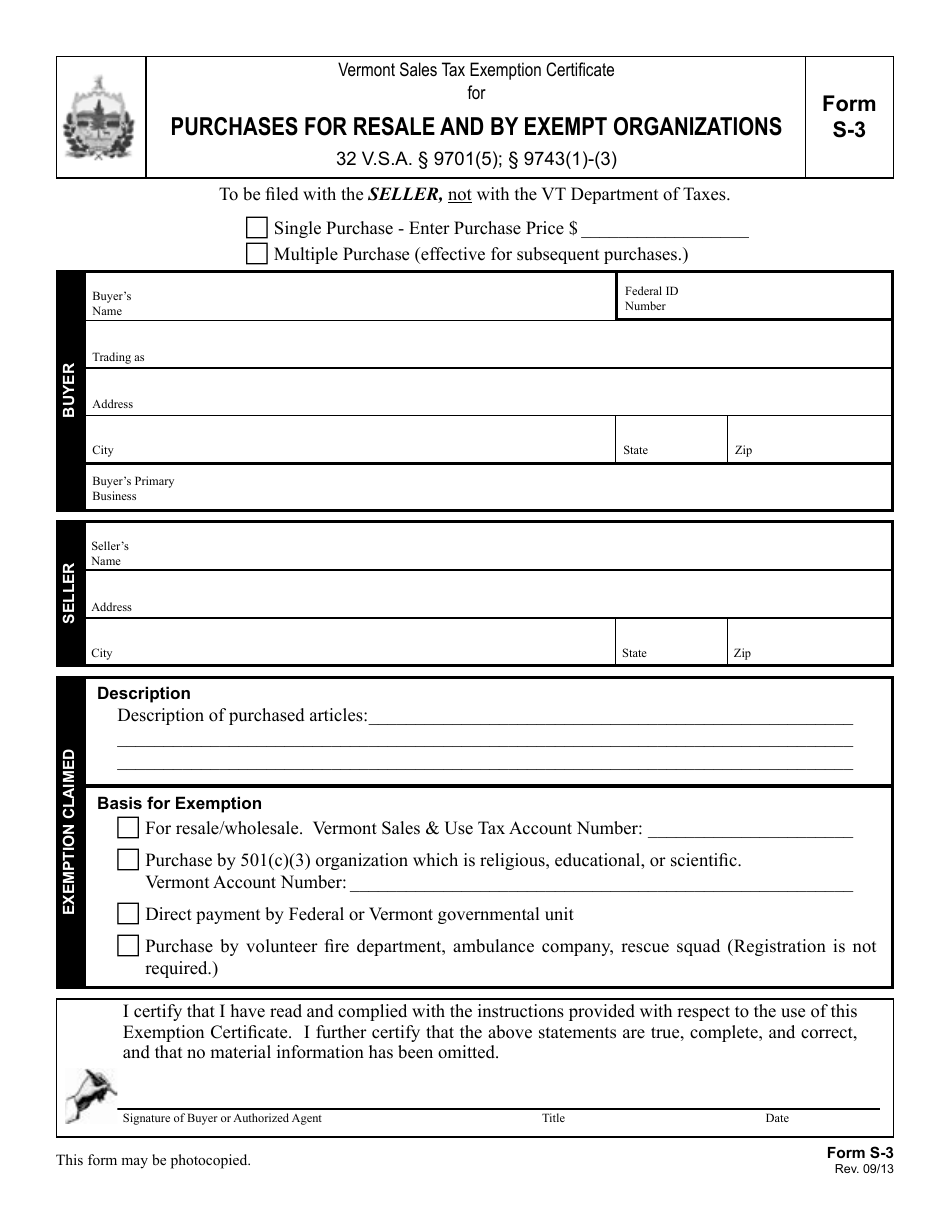

How to use sales tax exemption certificates in Vermont. Form S-3 Form Wednesday March 16 2022 - 1200 Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit File S-3pdf 8943 KB File Format PDF Tags Business and Corporate Exemption Sales and Use Tax. Annual renewal filing for duration of offering.

I also certify that this transaction is exempt under section 351 of the United State Internal Revenue Code. Verification of VINHIN form VT-010. Make Model Year YYYY.

If a Gift Tax Exemption claim is submitted with a registration or title and tax application that. A motor vehicle may be exempt from. To apply for tax exemption when the vehicle being registered is equipped with altered controls or a mechanical lifting device.

Sales tax exemption applies to hotel occupancy. You may complete Form PVR-317 Vermont Property Tax Public Pious or Charitable. IN-111 Vermont Income Tax Return.

Fillable PDF Forms.

State W 4 Form Detailed Withholding Forms By State Chart

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S

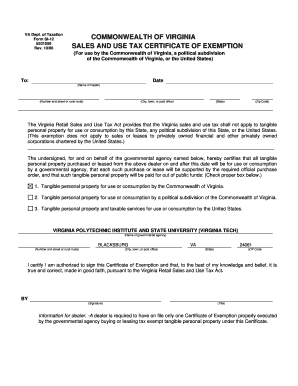

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Printable Vermont Sales Tax Exemption Certificates

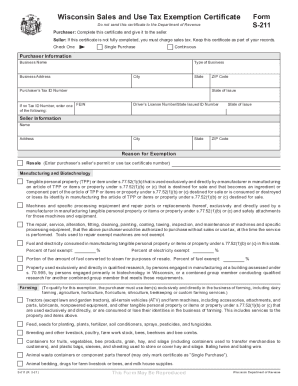

Get And Sign February S 211 Wisconsin Sales And Use Tax Exemption Certificate Fillable 2021 2022 Form

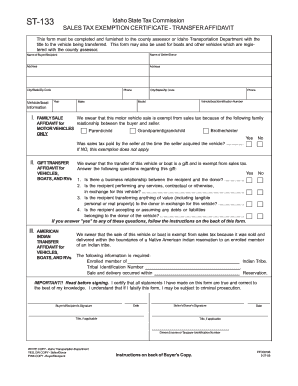

Idaho Sales Tax Exemption Form St 133 Fill Out And Sign Printable Pdf Template Signnow

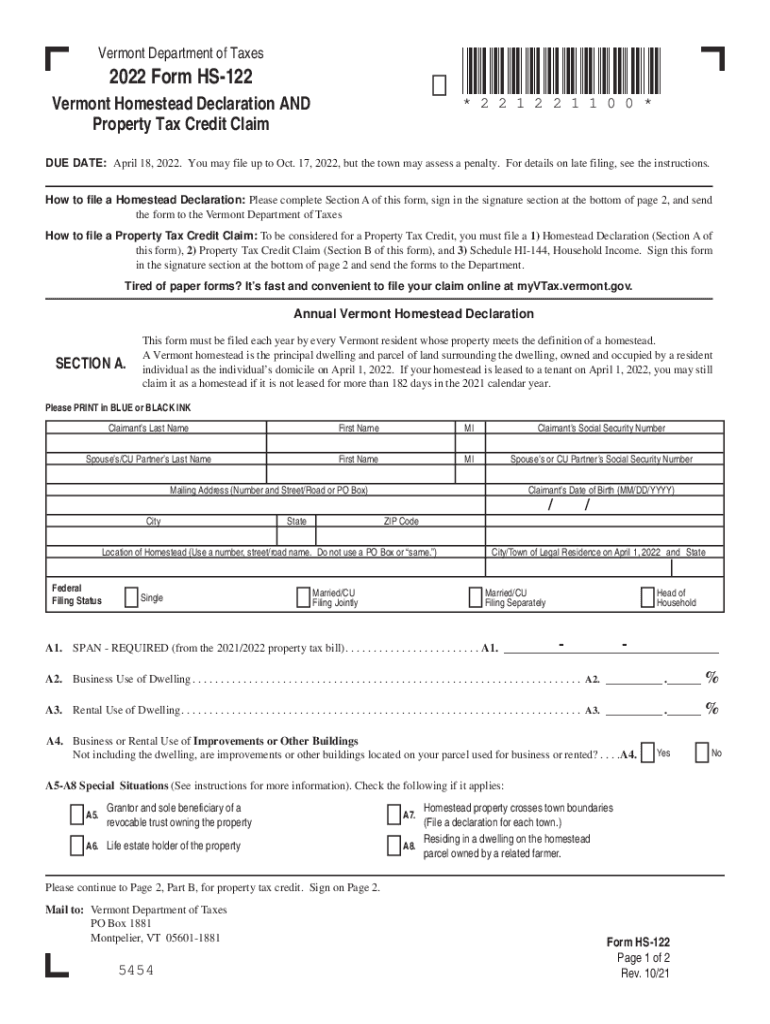

Vt Form Hs 122 2022 Fill And Sign Printable Template Online Us Legal Forms

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

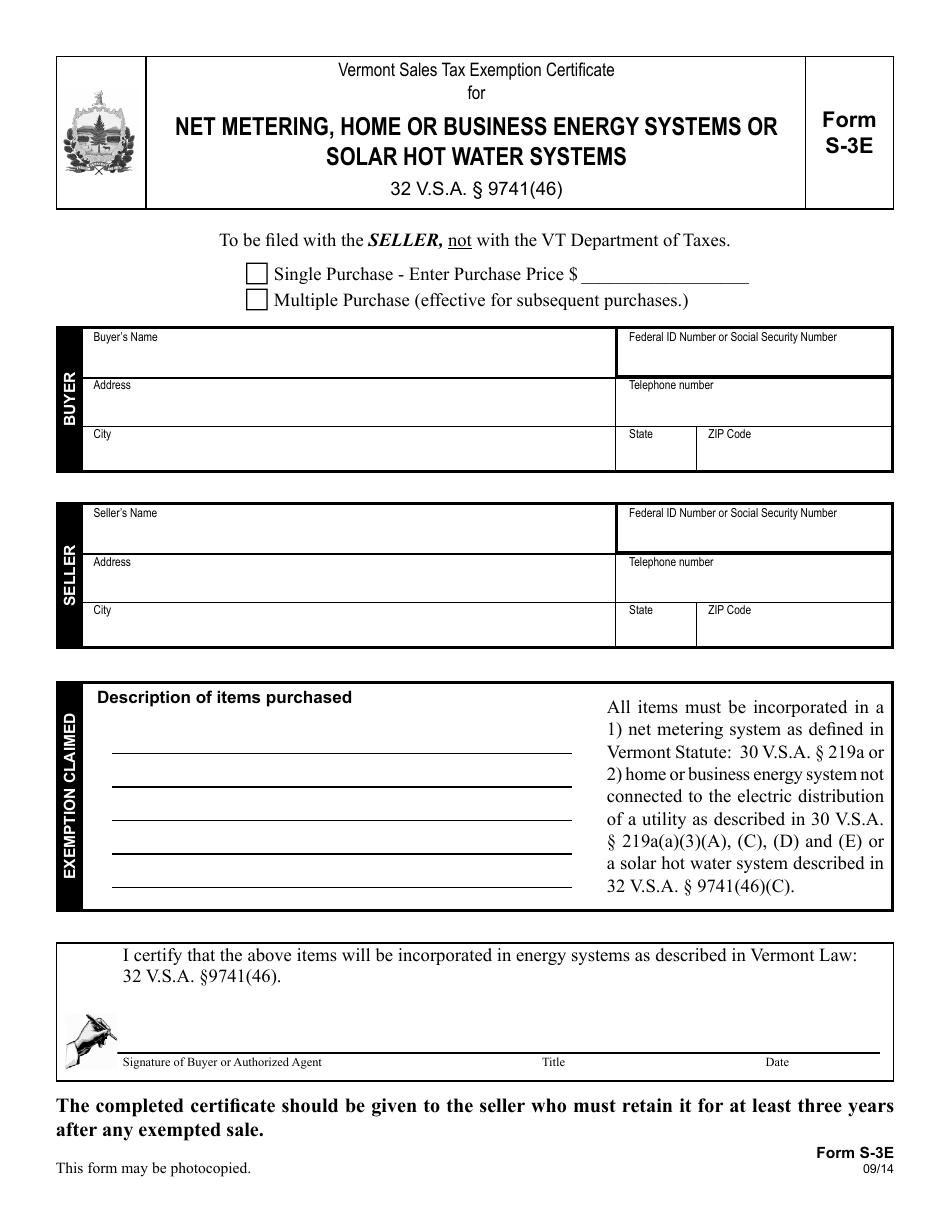

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Complete And E File Your 2021 2022 Vermont State Tax Return

Fillable Online Purch Vt Virginia Sales Use Tax Form 6201059 Fax Email Print Pdffiller

Vermont S Gov Scott Signs Tax Exemption For Native American Lands

Fillable Online Vermont Sales Tax Exemption Certificate For Form Fax Email Print Pdffiller